Best Home Equity Loans: Contrast Prices and Benefits

Best Home Equity Loans: Contrast Prices and Benefits

Blog Article

The Leading Reasons Why Property Owners Pick to Safeguard an Equity Loan

For several house owners, picking to safeguard an equity finance is a tactical financial decision that can provide various benefits. The capability to tap right into the equity constructed in one's home can supply a lifeline during times of monetary demand or act as a tool to accomplish details goals. From consolidating financial debt to embarking on major home restorations, the factors driving people to decide for an equity lending are impactful and diverse. Comprehending these inspirations can shed light on the sensible monetary planning that underpins such choices.

Financial Debt Loan Consolidation

Homeowners commonly choose safeguarding an equity financing as a calculated economic move for financial debt loan consolidation. By leveraging the equity in their homes, individuals can access a round figure of money at a reduced rates of interest compared to various other types of loaning. This resources can after that be utilized to pay off high-interest debts, such as credit rating card equilibriums or personal fundings, enabling property owners to improve their financial commitments into a single, more manageable month-to-month payment.

Debt debt consolidation through an equity finance can use numerous benefits to property owners. The lower interest price connected with equity finances can result in significant expense savings over time.

Home Renovation Projects

Taking into consideration the enhanced worth and performance that can be attained through leveraging equity, numerous individuals choose to allocate funds in the direction of numerous home renovation jobs - Alpine Credits Canada. Property owners typically choose to secure an equity loan specifically for restoring their homes as a result of the substantial rois that such tasks can bring. Whether it's updating outdated functions, broadening space, or enhancing power performance, home improvements can not just make living rooms more comfortable however also raise the total value of the residential or commercial property

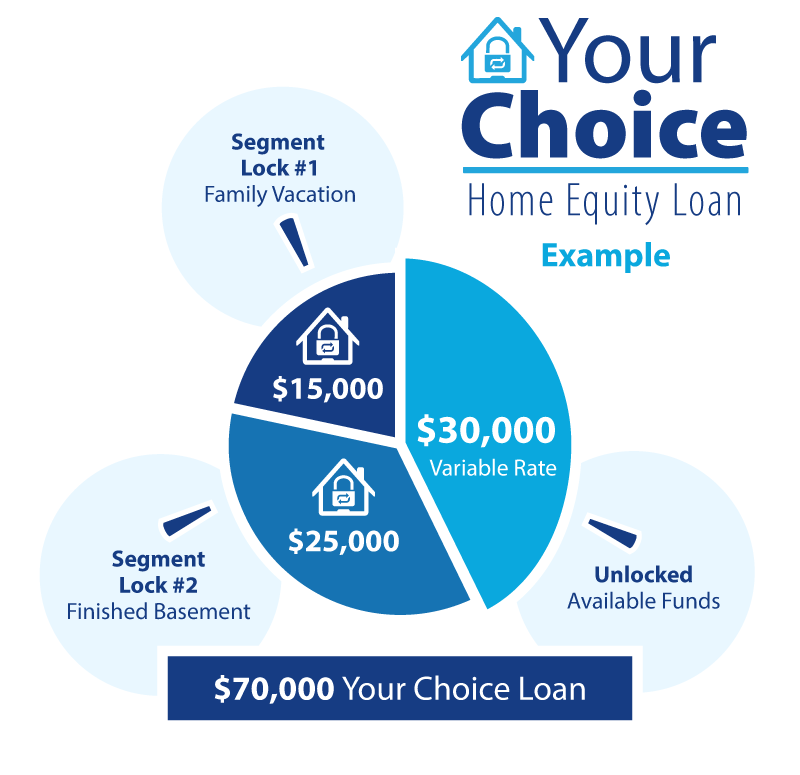

Typical home renovation projects moneyed with equity finances consist of kitchen remodels, bathroom renovations, cellar ending up, and landscape design upgrades. By leveraging equity for home improvement projects, house owners can develop spaces that better match their requirements and choices while additionally making a sound economic investment in their home.

Emergency Situation Expenditures

In unanticipated situations where prompt monetary assistance is required, securing an equity financing can offer homeowners with a practical service for covering emergency situation expenditures. When unanticipated occasions such as medical emergency situations, urgent home repairs, or abrupt job loss develop, having access to funds via an equity loan can offer a safety net for homeowners. Unlike various other types of loaning, equity fundings typically have lower rates of interest and longer payment terms, making them a cost-efficient option for resolving immediate economic demands.

One of the essential advantages of making use of an equity financing for emergency situation expenses is the speed at which funds can be accessed - Alpine Credits Equity Loans. Property owners can quickly use the equity accumulated in their residential property, enabling them to address pressing financial concerns without hold-up. Additionally, the flexibility of equity financings makes it possible for house owners to borrow only what they need, preventing the problem of taking on extreme financial obligation

Education Financing

Amidst the quest of higher education, protecting an equity lending can function as a critical funds for house owners. Education financing is a considerable problem for several households, and leveraging the equity in their homes can provide a way to gain access to required funds. Equity see it here fundings usually provide lower rates of interest compared to various other types of loaning, making them an appealing alternative for financing education and learning expenses.

By taking advantage of the equity developed in their homes, homeowners can access significant quantities of cash to cover tuition fees, publications, lodging, and other related expenses. Home Equity Loan. This can be specifically beneficial for moms and dads aiming to support their kids via college or individuals looking for to enhance their own education and learning. In addition, the interest paid on equity finances might be tax-deductible, giving possible economic advantages for consumers

Ultimately, using an equity finance for education and learning funding can assist people buy their future earning possibility and job advancement while properly handling their economic responsibilities.

Investment Opportunities

Verdict

To conclude, property owners choose to safeguard an equity loan for numerous reasons such as financial debt loan consolidation, home improvement tasks, emergency costs, education funding, and investment chances. These financings supply a method for homeowners to gain access to funds for important monetary requirements and objectives. By leveraging the equity in their homes, homeowners can make use of lower rate of interest and adaptable repayment terms to accomplish their economic objectives.

Report this page